Age-related macular degeneration market across 7MM forecast to reach $20.5 billion by 2034

The age-related macular degeneration market across the seven major markets is forecast to grow from $7.8 billion in 2024 to $20.5 billion in 2034, driven by longer-acting therapies, new mechanisms of action, treatments for geographic atrophy and the anticipated launch of the first therapy for early disease, according to GlobalData.

The seven major markets comprise the US, France, Germany, Italy, Spain, the UK and Japan. GlobalData said market growth will be supported by the expected launch of 26 novel pipeline agents alongside a rising prevalence of age-related macular degeneration across the forecast period.

According to GlobalData’s report Age-Related Macular Degeneration: Seven-Market Drug Forecast and Market Analysis, innovation across wet AMD, geographic atrophy and early AMD is expected to expand treatment options while addressing long-standing unmet needs related to treatment burden and durability of response.

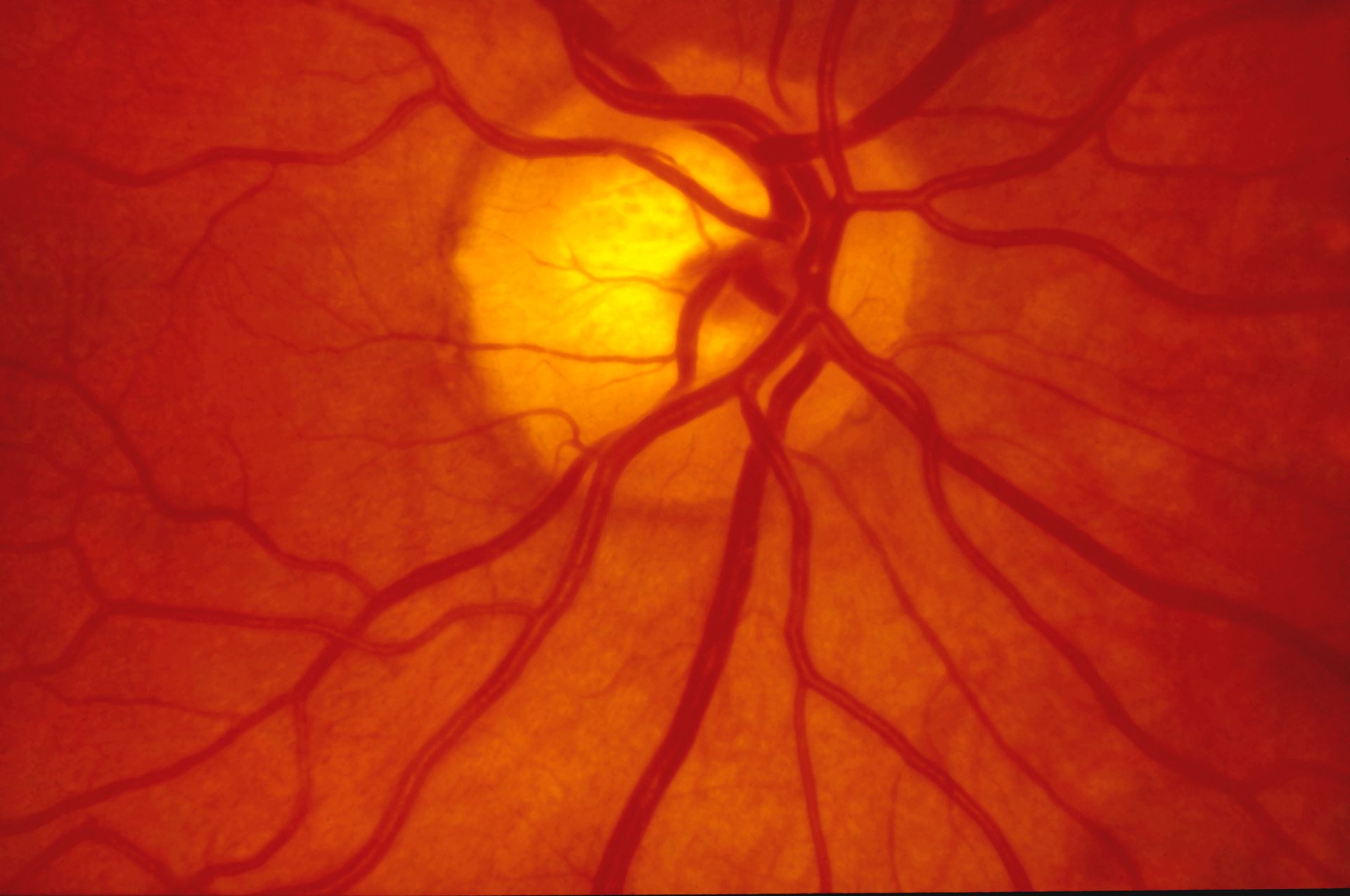

Sara Reci, managing pharma analyst at GlobalData, said: “While AMD does not lead to complete blindness, the loss of central vision can negatively impact patients’ quality of life as everyday tasks becomes increasingly challenging. In interviews with GlobalData, key opinion leaders emphasized that the greatest unmet needs in the AMD space include the need for longer-acting therapies, treatment for GA, the prevention of fibrosis, and reducing the burden on patients and the healthcare system.”

In wet AMD, several late-stage pipeline programmes continue to employ vascular endothelial growth factor mechanisms, mirroring existing standards of care. These include AbbVie and Regenxbio’s RGX-314, Adverum Biotechnologies’ ADVM-022, and 4D Molecular Therapeutics’ 4D-150.

At the same time, GlobalData highlighted a growing number of late-stage assets introducing new mechanisms of action. These include EyePoint Pharmaceuticals’ Duravyu, Ocular Therapeutix’s Axpaxli, Ashvattha Therapeutics’ D-4517 and Merck’s MK-3000, which targets the wingless-related integration site pathway.

The geographic atrophy pipeline includes 12 late-stage therapies across the seven major markets. Programmes highlighted by GlobalData include Annexon’s ANX-007, Ocugen’s OCU-410 and Lineage Cell Therapeutics’ OpRegen. While two therapies are already approved for geographic atrophy in the US and one is conditionally approved in Japan, GlobalData noted that no therapies are currently approved in the EU, positioning the late-stage pipeline as particularly significant for European patients.

Reci added: “While there are already two therapies on the market for GA in the US, and one conditionally approved therapy for GA in Japan, the late-stage pipeline is of great benefit for patients in the EU, where there are no approved therapy options for GA.”

GlobalData also pointed to early AMD as an emerging market segment. Novartis’ Fabhalta, which is already marketed for several renal and haematological indications, is expected to launch for early AMD across the seven major markets within the forecast period.

The report also highlighted a gradual shift away from an exclusive reliance on intravitreal administration. While most approved therapies still use this route, several late-stage candidates are exploring subcutaneous and oral delivery options, which could reduce treatment burden for patients and healthcare systems.

Longer dosing intervals remain a dominant trend across the pipeline. GlobalData forecasts that high-dose Eylea will retain a significant share of the wet AMD market due to its potential to extend treatment intervals, although competition from Roche and Genentech’s Vabysmo is expected to intensify.

Despite strong growth prospects, GlobalData warned that the AMD market may face pressure from upcoming losses of market exclusivity and the anticipated entry of biosimilars. Reci said: “Nonetheless, the launch of late-stage pipeline therapies with new mechanisms of action, routes of administration, longer treatment intervals, and improved efficacies will undoubtedly be a driving force for market growth in the AMD space.”